In early September, the Federal Reserve cut its benchmark interest rate by 50 basis points. At that time, many expected both long-term and short-term bond rates to universally decline. With this in mind, I purchased $3,000 worth of 20-year U.S. Treasury bonds. Based on the information I had gathered before the rate cut, it was possible that long-term bond rates would not immediately react to the Federal Reserve’s rate change. This is because long-term bond rates generally have a positive correlation with the Fed’s interest rate, but not an instantaneous one. Over time—months or years—the bond rate tends to move in the same direction as the Fed’s rate, but in the short term, this might not hold true.

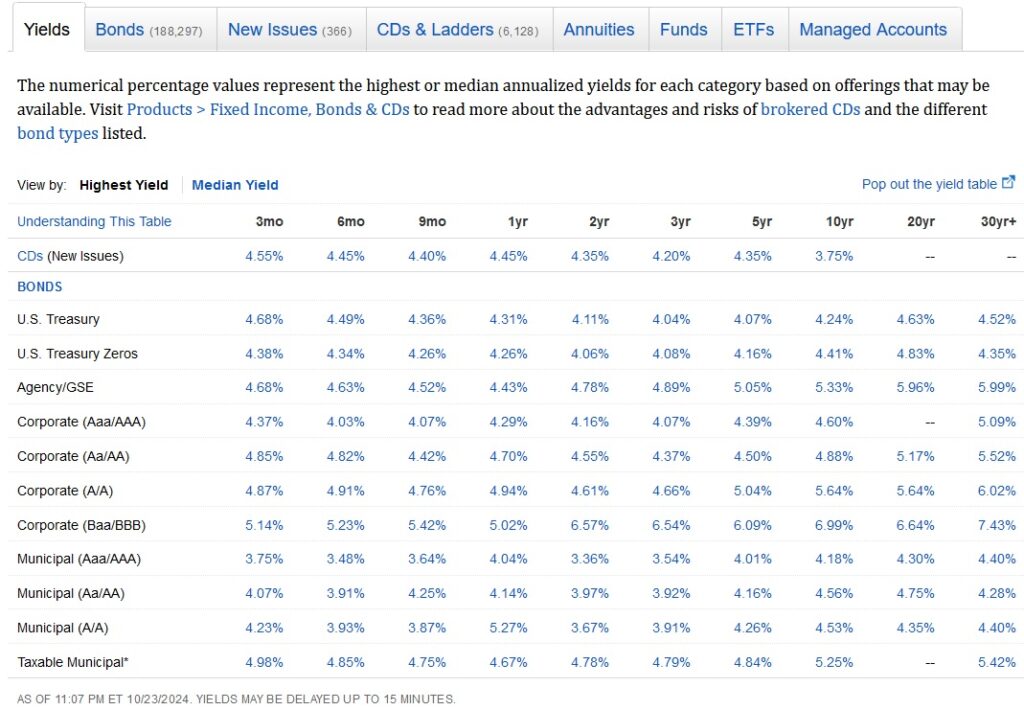

My $3,000 purchase was an experiment to test this concept and “put some skin in the game.” Interestingly, after the Fed’s rate cut, the 3-month T-Bill yield dropped almost immediately, but the 10-, 20-, and 30-year bond yields actually went up. When I made my purchase, the 20-year bond yield was 4.09%; now, less than a month later, it has risen to 4.63% as of today (10/23/2024). This means the value of my bond has already dropped by roughly 10%. But why?

One possible explanation is that many investors bought long-term bonds right before the rate cut, thinking it might be their last chance to lock in a decent rate of return. They anticipated that after the rate drop, the bonds they had just purchased would become more valuable. This rush to buy bonds before the Fed’s meeting increased demand, causing bond prices to rise and yields to fall. However, after the rate cut, demand was essentially exhausted, and bond yields increased.

Another reason could be the strong economic data following the rate cut, which indicated the U.S. economy remains robust with a low unemployment rate. This resilience led to more moderate expectations of future rate cuts. With investors now expecting fewer rate cuts in the near future, long-term bond yields have risen.

Although the 20-year bond I purchased last month has decreased in value so far, I believe it presents a good opportunity to buy more bonds at the higher yield with the general expectation that the Fed will continue to make more rate cuts in the coming year.